Stripe is a pay-as-you-go payment processing platform with flat-rate, transaction-based fees.

Overall, you’ll pay 2.9% plus 30 cents per transaction to accept card payments online and 2.7% plus 5 cents to accept in-person payments with Stripe. It does not charge monthly or annual fees. In general, the only costs you’ll incur will be transaction fees, otherwise known as credit card processing fees.

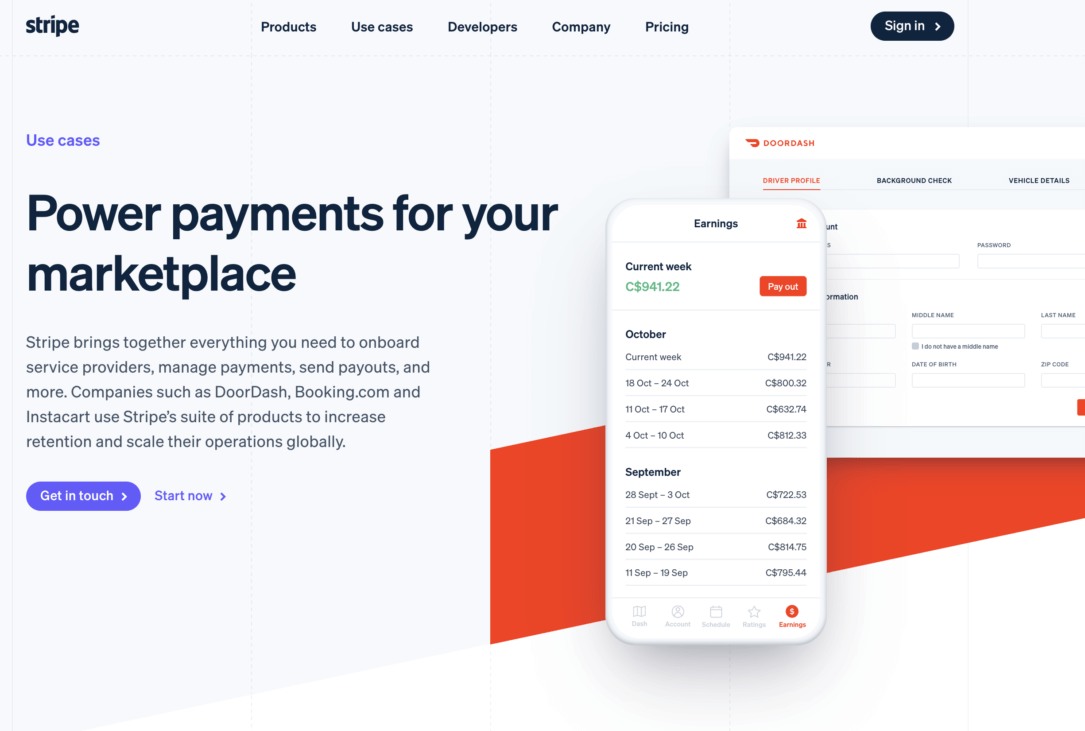

This is why we chose Stripe as the payment processor for CanuckCo.ca . It is easy to setup to be a vendor without needing a registered business bank account. You can use your personal account and start selling today!

Stripe’s flat-rate fee structures are generally easier to understand than more complicated interchange-plus pricing, where fees vary based on card type. Because it’s a payment service provider, it’s also fast to set up. But like other PSPs, account holds or closures are more of a risk than with merchant account providers.

Volume discounts, multiproduct discounts, country-specific rates and interchange pricing are available for large-volume businesses or companies with unique business models.

Stripe processing fees

The main cost to use Stripe comes from flat-rate processing fees. Generally, your business will pay the same rate on every transaction regardless of the size of the transaction, type of card that’s used or the network that issued the card. Your rate may vary based on your country, though; services are available in more than 30 countries around the world.

Standard fees for businesses operating in the U.S. include:

|

Payment method

|

Price structure

|

|---|---|

|

Cards and digital wallets

|

|

|

Online: Debit and credit cards, Apple Pay, Google Pay, Alipay, Click to Pay and WeChat Pay

|

2.9% plus 30 cents per transaction.

|

|

In-person: Payments through Stripe Terminal

|

2.7% plus 5 cents per transaction.

|

|

Bank transactions

|

|

|

Checks

|

$5 per check received.

|

|

ACH credit

|

$1 per ACH credit payment.

|

|

ACH direct debit

|

0.8% per transaction (maximum ACH fee of $5).

|

|

Wire transfer

|

$8 per wire payment.

|

International transactions

Stripe supports popular payment methods from around the world, including Bancontact, EPS, Giropay, iDEAL, Multibanco, pre-authorized debits in Canada, Przelewy24, SEPA Direct Debit and Sofort. Pricing varies by payment method, and an additional 1.5% fee applies for international payment methods plus 1% fee for currency conversion.

Stripe also accepts Afterpay and Klarna transactions. These two global payment methods provide your customers with the options to buy now, pay later or finance their purchases.

How does Stripe charge fees?

Stripe charges fees automatically, reducing your regular payouts by the amount of fees owed.

When you set up your Stripe account, you’ll be required to connect your business bank account. After you’ve completed the setup process and start processing payments, you’ll build a balance in your account. When a payment is first received, it will show as a pending balance and will consist of the amount of the transaction minus any fees, which are automatically deducted when moving funds from its account to yours.

Your balance will change from pending to available according to your payout schedule. Generally, U.S. businesses operate on a two-business-day payout schedule, which means payouts of your available account balance are made daily and contain credit card payments processed two business days prior. If you operate in a high-risk industry, you may be set on a 14-day payout schedule.