What is Stripe?

When customers pay your business for products or services using cash or a check, those payments can be deposited into the business bank account. However, if they want to make payments using a credit card, you’ll need a payment processor.

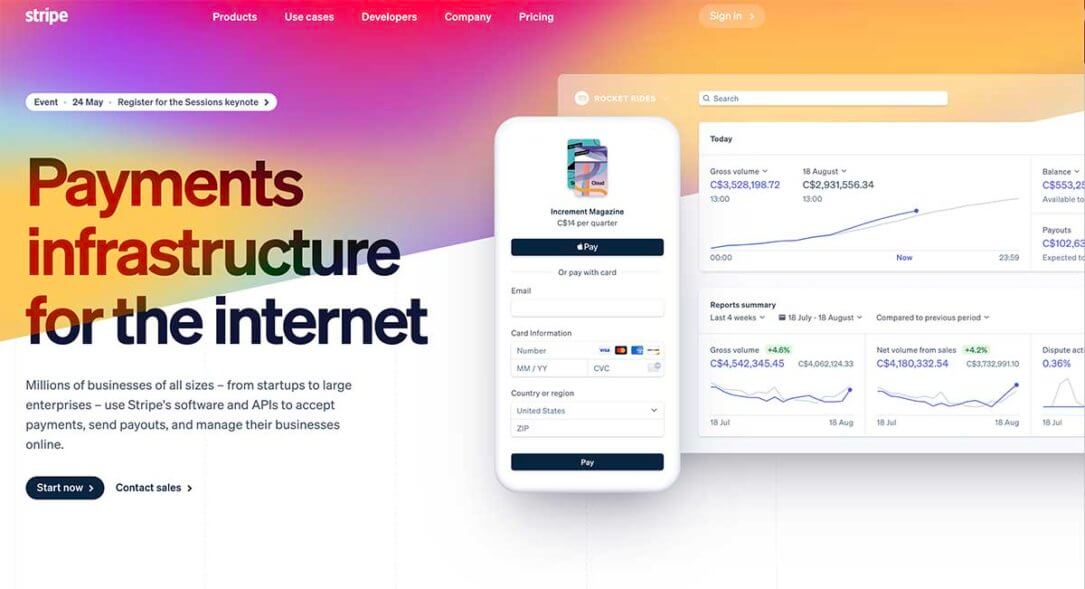

As a payment processor, Stripe allows business owners to accept payments from credit and debit cards and processes those payments. Using Stripe, businesses can also accept payments from mobile wallets and buy now, pay later services. Stripe also supports payments in a variety of currencies. Stripe Payments is the software that processes those payments.

If you’ll want to use Stripe to accept in-person payments, the company offers Stripe Terminal, a point-of-sale system. If you plan on taking only online payments, then you won’t need it.

In addition to processing payments in person and online, Stripe offers lots of additional services, including billing, invoicing and sales tax automation.

How does Stripe work?

Stripe Payments handles the steps between a customer providing their card information and learning that their payment has been accepted.

Here’s how it works:

-

First, the customer provides their card information, either online or in person.

-

Those card details enter Stripe’s payment gateway, which encrypts the data.

-

Stripe sends that data to the acquirer, a bank that will process the transaction on the merchant’s behalf. In this step, Stripe serves as the merchant (with the business owner as a sub-merchant). This means Stripe users don’t have to set up a merchant account, which can be cumbersome.

-

The payment passes through a credit card network, like Visa or Mastercard, to the cardholder’s issuing bank.

-

The issuing bank approves or denies the transaction.

-

That signal travels from the issuing bank through the card network to the acquirer, then through the gateway to the customer — who sees a message telling them the payment has been accepted or declined.

Once the cardholder’s issuing bank finalizes its approval, you can transfer funds from Stripe into your business bank account. Stripe customers can receive payouts when transactions have finished processing (usually around two business days). Payouts can also be made on a schedule of your choosing (daily, weekly or monthly).

You’ll pay Stripe for facilitating each transaction. These fees vary by transaction type; for example, each successful online payment costs 2.9% plus 30 cents, whereas in-person fees are 2.7% plus 5 cents.

Who uses Stripe?

Some of the world’s largest companies, including Amazon and Shopify, use Stripe. But any merchant who accepts credit and debit cards or mobile wallet payments can use this payment processor.

Stripe is best suited for business owners who do much of their business online, as most of its unique features — such as its open application programming interface and ability to accept more than 135 currencies — are primarily relevant to online sales.

Is it safe to use Stripe?

Stripe has been audited and certified as a PCI Level 1 service provider, which means it has to undergo an annual compliance report and routine security scans and tests.

Stripe encrypts all customers’ credit card numbers and stores decryption information separately, which means Stripe can’t see credit card numbers without taking extra steps.

Also, Stripe mandates that all online transactions take place over the more secure HTTPS network.

How to start using Stripe

To begin using Stripe, take a few steps:

-

Create a Stripe account. You can do this with just your name and email address.

-

Provide business details. This will include the address and legal structure. Stripe will also request personal information about you, including your full name and date of birth.

-

Link a bank account. This is where you’ll receive payouts from Stripe.

You won’t be able to collect payouts immediately, however. You generally can’t receive your first payout until seven days after you’ve taken your first payment. In some industries, the waiting period can be as long as 14 days.